Resumo

The demographic dividend has aroused interest among demographers and economists because it is seen as a window of oportunity for the economic development of countries that have experienced a demographic transition. There are reasons to question the sole virtuosity of the pure demographic dividend in economic growth. Crespo-Cuaresma et al. (2014)CRESPO-CUARESMA, J.; LUTZ, W.; SANDERSON, W. C. Is the demographic dividend an education dividend? Demography, v. 51, n. 1, p. 299-315, 2014. found that educational expansion has an important role in economic gains during the demographic dividend. To verify these results for the Brazilian case, we performed a decomposition exercise of economic support ratio (ESR), an alternative to demographic dependency ratio, to analyze the first demographic dividend. A simulation, applied for the period from 1970 to 2100 considering three scenarios of educational expansion, shows that educational expansion was and will be responsible for a big share of the economic gains of the Brazilian demographic dividend period, outperforming the change in age structure effect. In addition, an increase in a work-age population with post-secondary education appears to potentialize these results.

Key words

Demographic dividend; National Transfer Account (NTA); Education

Abstract

O dividendo demográfico tem despertado interesse entre demógrafos e economistas por ser visto como uma janela de oportunidade para o desenvolvimento econômico dos países que vivenciam a transição demográfica. É possível questionar a virtuosidade do dividendo puramente demográfico no crescimento econômico. Crespo-Cuaresma et al. (2014) observaram que a expansão educacional tem papel importante nos ganhos econômicos durante o dividendo demográfico. Para verificar esse resultado para o caso brasileiro, realizamos um exercício de decomposição da razão de suporte econômico (ESR), uma alternativa à taxa de dependência demográfica na análise do primeiro dividendo demográfico. A simulação realizada para o período entre 1970 e 2100, considerando três cenários de expansão educacional, mostrou que a ampliação do nível de escolaridade foi e será responsável pela maior parte dos ganhos econômicos do período do dividendo demográfico, superando o efeito da mudança da composição etária. Além disso, o aumento da população em idade ativa com ensino superior tende a potencializar esse resultad

Palavras-chave

Dividendo demográfico; Contas Nacionais de Transferência (CNT); Educação

Resumen

El dividendo demográfico ha despertado interés entre los demógrafos y economistas, ya que se considera una ventana de oportunidad para el desarrollo económico de los países que experimentan la transición demográfica. Es posible cuestionar el virtuosismo del dividendo puramente demográfico en el crecimiento económico. Crespo-Cuaresma y cols. (2014) vieron que la expansión educativa juega un papel importante en las ganancias económicas durante el dividendo demográfico. Para verificar este resultado para el caso brasileño, se hizo un ejercicio de descomposición del índice de apoyo económico (ESR), una alternativa al índice de dependencia demográfica en el primer análisis demográfico de dividendos. La simulación realizada para el período 1970-2100, considerando tres escenarios de expansión educativa, mostró que la expansión del logro educativo fue y será responsable de la mayoría de las ganancias económicas del período de dividendos demográficos, superando el efecto del cambio en la composición etaria. Además, el aumento de la población en edad laboral con educación superior tiende a potenciar este resultad

Palabras clave

Dividendo demográfico; Cuentas Nacionales de Transferencias (CNT); Educación

Introduction

The “demographic dividend” is the result of a change in age structure of a population caused by population aging that, in turn, is the consequence of a demographic transition. The decline in the youth dependency ratio (0-14/15-64) marks the early stage of a demographic dividend, when total birth rate declines substantially due to the demographic transition. At the same time, the old-age dependency ratio (65+/15-64) starts to rise due to population aging. The end of this demographic dividend takes place when the total dependency ratio reaches a minimum point, driven by the interaction between the youth and old-age dependency ratio driving forces.

This demographic phenomenon has aroused interest among demographers and economists because it is seen as a window of oportunity for the economic development of countries that have experienced a demographic transition. The fact that work-age population growth ratio is higher than dependent population growth ratio tends to increase the available resources for investment in economy (CUTLER et al., 1990CUTLER, D.; POTERBA, J.; SHEINER, L.; SUMMERS, L.; AKERLOF, J. An aging society: opportunity or challenge. Brookings Papers on Economic Activity, v. 21, n. 1, p. 1-73, 1990.; CARVALHO; WONG, 1995CARVALHO, J. A. M.; WONG, L. A. Window of opportunity: some demographic and socioeconomic implication of rapid fertility decline in Brazil. Belo Horizonte: Cedeplar/ UFMG, 1995. (Texto para discussão, 91).). Bloom and Williamson (1997)BLOOM, D. E., WILLIAMSON, J. G. Demographic transitions and economic miracles in emerging Asia. World Bank Economic Review, v. 12, n. 3, p. 419-455, 1998., for example, showed that part of the Asian Miracle of economic expansion is explained by the shift in age structure that occurred between 1960 and 1995. In Brazil, Queiroz and Turra (2010)QUEIROZ, B. L.; TURRA, C. M. Window of opportunity: socioeconomic consequences of demographic changes in Brazil. Washington, DC: NTA, 2010. showed that almost 100% of economic growth from 1970 to 2010 can be attributed to a demographic dividend.

There are reasons to question the sole virtuosity of the pure demographic dividend in economic growth. In the context of growth models including human capital and total factor productivity (SOLOW, 1956SOLOW, R. M. A contribution to the theory of economic growth. Quarterly Journal of Economics, v. 70, p. 65-94, 1956. DOI:10.2307/1884513.; MANKIW et al., 1992MANKIW, N. G.; ROMER, D.; WEIL, D. W. A contribution to the empirics of economic growth. Quarterly Journal of Economics, v. 107, n. 2, p. 407-437, 1992.), Crespo-Cuaresma et al. (2014) found that the rise of a work-age population share does not take place beyond the translation effect. According to these authors, the effects on economic growth so far attributed to the demographic dividend “need to be understood in the context of the educational expansion that accompanied the observed changes in age structure” (CRESPO-CUARESMA et al., 2014, p. 311). Both the decrease in birth rate and the work productivity effect embedded in the demographic dividend can be explained through the increase in educational attainment of the work-age population. The demographic dividend assigned only to changes in age structure turned out to be small. If there is a dividend at all, it is an educational dividend.

In the context of the National Transfer Account (NTA) project, it is possible to move from the pure demographic dependency ratio to the economic support ratio – the ratio of effective production to effective consumption – to measure the demographic dividend. In order to do that, we used the difference between income and consumption age profiles plus total population by age (MASON, 2005MASON, A. Demographic transition and demographic dividends in developed and developing countries. In: UNITED NATIONS EXPERT GROUP MEETING ON SOCIAL AND ECONOMIC IMPLICATIONS OF CHANGING POPULATION AGE STRUCTURE. Proceedings [...]. Mexico City: United Nations, Population Division, 2005.; MASON; LEE, 2006MASON, A.; LEE, R. Reform and support systems for the elderly in developing countries: Capturing the second demographic dividend. Genus, v. 52, n. 2, p. 11-35, 2006.). This methodology allows us to calculate the economic surplus generated during the demographic dividend period; a method that has already been explored (OOSTHUIZEN, 2015OOSTHUIZEN, M. Bonus or mirage? South Africa’s demographic dividend. Journal of the Economics of Ageing, v. 5, p. 14-22, 2015.; PRSKAWETZ; SAMBT, 2014PRSKAWETZ, A.; SAMBT, J. Economic support ratios and the demographic dividend in Europe. Demographic Research, v. 30, n. 34, p. 963-1010, 2014.; ROSERO-BIXBY, 2011ROSERO-BIXBY, L. Generational transfers and population aging in Latin America. Population and Development Review, v. 37, suppl., p. 143-157, 2011.).

In this paper we intend to extend the NTA framework incorporating educational attainment by age in both income and consumption profiles of the economic support ratio (ESR) in order to measure the education expansion effect on demographic dividend. We applied to the Brazilian case a decomposition exercise performed by Rentería et al. (2016)RENTERÍA, E.; SOUTO, G.; MEJÍA-GUEVARA, I.; PATXOT, C. The effect of education on the demographic dividend. Population and Development Review, v. 42, n. 4, p. 651-671, 2016. in the context of Mexico and Spain. They followed a decomposition of the growth rate in the economic support ratio as advanced by Mason (2005), and Mason and Lee (2006), including education by age as a new dimension.

Our exercise focused on the period between 1970 and 2100, considering three scenarios of educational expansion: low, medium and high. The results show that, in the Brazilian case, the educational attainment expansion was and will continue to be responsible for the biggest factor effecting the economic gains of the demographic dividend period; outperforming the age structure change effect. Additionally, the growth of work-age population with post-secondary education tends to potentialize this result.

Methods – decomposition

Mason (2005), and Mason and Lee (2006) set the basis for a decomposition exercise in the NTA context to focus in the economic support ratio (ESR) rather than the demographic dependency ratio. They describe the labor income (L) and consumption (C) as its components in the formulas below.

Where ci , li , and Ni are average consumption, average labor income, and population, by age i in a given period t. Like in the case of demographic support ratio growth described in the introduction, the demographic dividend debate in the NTA context will change to the focus to the analysis of the ESR’s growth rate, as defined below:

The ESR is affected by the age profiles of consumption and labor income, as well as by the population age structure. If the age structure shifts towards the active age population, then there is an increasing chance of generating economic surplus in society.

The most recent technical advance suggested by Rentería et al. (2016) is to include the effect of educational composition by age in the ESR. To do so it is necessary to disaggregate equations 1 and 2 by education groups. Educational expansion through time will determine changes in this educational composition. If we index the education groups by j, we define the equations below:

We can decompose the ESR in three effects: effect due to changes in age structure (A) or age effect, effect due to changes in education composition (E) or education effect, and the effect due to changes in the labor income and consumption profiles (R) or rate effect.

Following the analysis in Rentería et al. (2016) we apply the decomposition developed by Das Gupta (1993)DAS GUPTA, P. Standardization and decomposition of rates: a user’s manual. US Bureau of Census, Current Population Reports, Series P23-186. Washington, DC: US Government Printing Office, 1993., dividing the ESR’s annual growth rate in the three effects below:

Where:

The difference between e captures changes in L or in C while the age composition (i) and education composition (j) are held constant. The labor income and consumption age profile are the components changing (lyij e cij). By the same reasoning, the calculation of the age and education effects keep constant the other factors.

The mechanics of the decomposition to calculate g(L) is as follows.1 1 The same logic applies to g(C). First, we calculate the rate, education, and age effects.

To obtain the compositional education and age components of population we have:

Second, we calculate the growth rate components: g(R)L, g(A)L e g(E)L.

We divide each effect obtained in equation 7 by L(t), namely, per capita labor income in period t.2 2 The same logic applies in the case of C(t).

The final step is to measure the impact of each component in ESR’s rate of growth.

Data

To calculate the labor income and consumption age profile, we used the data from the Brazilian survey Pesquisa de Orçamento Familiar (POF) 2008-2009 (IBGE, 2010IBGE – Instituto Brasileiro de Geografia e Estatística. Pesquisa de Orçamentos Familiares 2008-2009 – POF. Rio de Janeiro, 2010.), which provides information about expenditure and income of household residents, allowing us to analyze the Brazilian budget age structure. We also extracted macroeconomic data from 2008 on income and expenditure from Sistema de Contas Nacionais do Brasil (IBGE, 2016IBGE – Instituto Brasileiro de Geografia e Estatística. Sistema de Contas Nacionais: Brasil. Rio de Janeiro, 2016. Available at: https://www.ibge.gov.br/estatisticas-novoportal/economicas/contas-nacionais/9052-sistema-de-contas-nacionais-brasil.html.

https://www.ibge.gov.br/estatisticas-nov...

).

To adjust the profile we followed the NTA manual (UNITED NATIONS, 2013UNITED NATIONS. National transfer accounts manual. Measuring and analysing the generational economy. New York: Population Division, Department of Economic and Social Affairs, United Nations Publication, 2013.). According to NTA methodology, the income age profile is the average annual labor income per capita of the population at each age. Similarly, the consumption age profile is based on average annual consumption per capita of the population at each age, including all public and private expenditures on education, healthcare and other factors. The difference between the consumption and income profiles is the life cycle deficit, indicative of economic dependency throughout the live spans of individuals.

In Figure 1 we display the labor income and consumption age profile of the Brazilian population in 2008. We can see the standard life cycle has an almost flat age consumption profile and an inverted U-shaped labor income age profile, where income is higher than consumption around age 20 and lower again around age 60. This profile generates the basis for the calculation of the ESR during demographic transition and education expansion.

Figures 2 and 3 show high inequality among both income and consumption group profiles based on educational achievement. This is particularly true in the case of post-secondary (tertiary) education group, which displays a much higher income and consumption pattern in relation to the other groups. Even though the profiles in the secondary education group are high, they are still significantly lower than the post-secondary education group. The two lowest education groups exhibit a flat and low age income and consumption profile. Figure 4 shows that the life cycle deficit is much higher in the post-secondary group. From this descriptive analysis we can already infer that the impact of the age-education dynamics in the ESR will depend of the trajectory in the post-secondary education group.

The populational data of the age composition by educational attainment was taken from projections in Wittgenstein Centre for Demography and Global Human Capital (WICD, 2015), calculated for the period of 1970 to 2100 in three different education attainment scenarios: low, medium, and high.

-

Scenario 1: this is the medium scenario where education expansion follows the global trend, with a global growth in the enrollment rates.

-

Scenario 2: this is the low scenario, where enrollment rate is constant through time.

-

Scenario 3: this is the high scenario, where schooling mimics the expansion observed in South and Southeast Asia.

For all scenarios, we use only one population projection scenario, with the same assumptions on the evolution of birth rate, mortality, and migration rates.

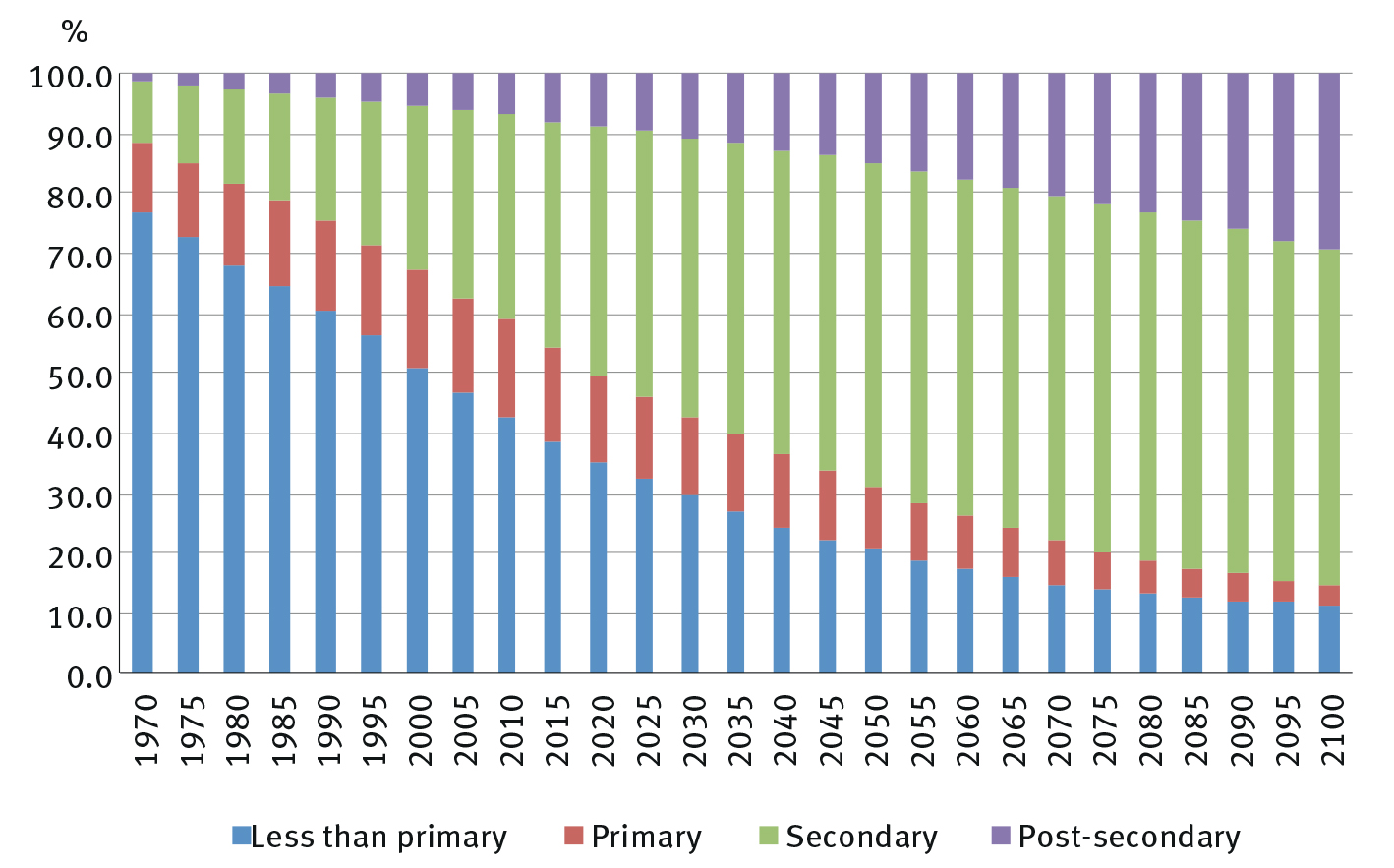

The major difference between the three scenarios is the population share of people with secondary and post-secondary (or tertiary) education. We show these differential trends in Figures 5, 6, and 7 below. In the medium scenario (Figure 5) the modal educational group represents secondary education starting early this century. The trend in the low scenario (Figure 6) is similar, but there is a persistent share of the segment with less than primary education. Only in the high scenario (Figure 7) does post-secondary education overtake the modal share in the second half of the 21st century, although this share grows throughout the century. In Figure 8 we show that the pure demographic aging process puts the end of the demographic dividend at around 2020, when the total dependency ratio reaches its minimum. There is a growing upward trend in total and old-age dependency ratios after that turning point.

Results

We simulate the ESR during a Brazilian demographic transition between 1970 and 2100. We decompose this trajectory in the age and education components: g(A) e g(E). As mentioned in the data section, we used only one household expenditure survey. Thus, we hold the rate profiles constant and ignore g(R) in the exercise. We assume that there is no change in L or in C profiles by age (i) and education (j), although we expect these profiles to vary over time because of the increase in educational attainment itself. As shown by Menezes et al. (2007)MENEZES, F. N.; FERNANDES, R.; PICHETTI, P. Educação e queda recente da desigualdade no Brasil. In: BARROS, R. P.; FOGUEL, M. N.; ULYSSEA, G. (org.). Desigualdade de renda no Brasil: uma análise da queda recente. Brasília: Ipea, 2007. p. 285-304., these increases in Brazilian educational attainment have led to a reduction of labor income difference among the educational groups.

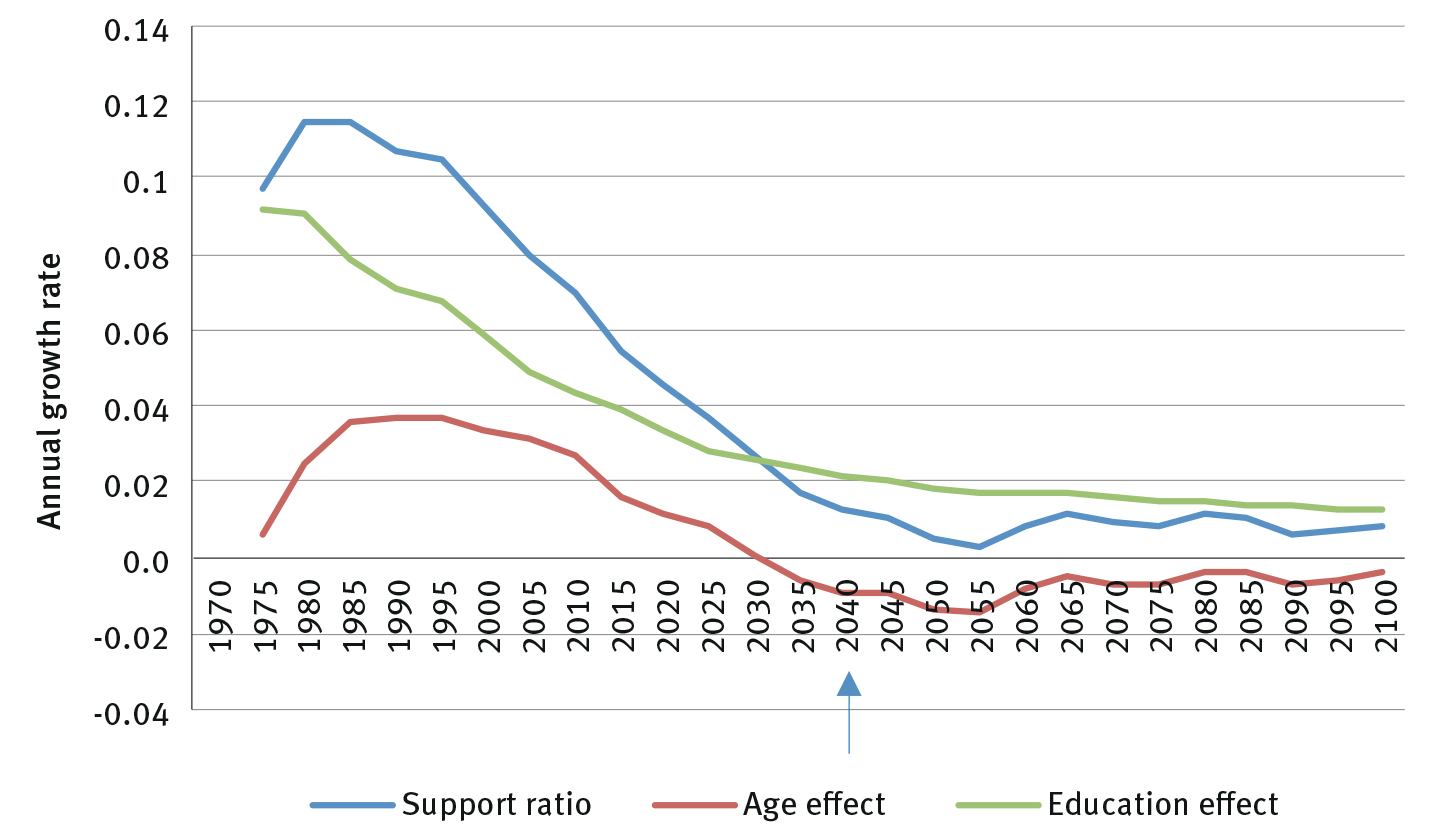

Our decompositions of the ESR by age and education effects are presented in Figures 9, 10, and 11. We used an arrow in 2040 in all figures to analyze the impact of the scenarios in that period. Figure 9 illustrates the medium scenario, where the age effect component leads to a negative growth in the support ratio before 2040 (around 2030). The positive impact of the education effect leads to a positive ESR that is still growing above 1% in 2040. In Figure 10 we can see that in the high scenario, the age effect component leads to a negative growth only around 2040, while the positive education effect leads to ESR’s growth around 4% in 2040. Figure 11 shows that in the low scenario, the age effect becomes negative around 2030, following the pattern of the medium scenario, and the education effect leads to the end of the ESR’s dividend around 2040, with a growth rate around zero at that point.

Final remarks

The aim of this paper is to analyze the role of educational expansion during a period of pure demographic dividend; that moment in the demographic dividend when the work-age population growth ratio is higher than the economic dependent population growth ratio. This subject is of great interest to countries that are going through a period of population aging for two reasons: 1) it allows them to take advantage of the economic surplus generated by the relative decrease in their dependent population and, 2) to avoid the negative economic impact brought on by the relative increase in elderly individuals within a population.

The results of the Brazilian economic support ratio decomposition in the effects of the age structure change and of the educational attainment increase shows that it is impossible to disassociate educational expansion effects on economic results during a period of demographic dividend, confirming the findings of Crespo-Cuaresma et al. (2014). In the high scenario, the age effect tends to decrease, while the pure demographic dividend duration tends to increase. These results are expected due to the decrease in birth rates resulting from an increase in women of child bearing age entering the labor market as a result of higher educational attainment (BONGAARTS, 2010BONGAARTS, J. The causes of educational differences in fertility in sub-Saharan Africa. Vienna Yearbook of Population Research, v. 8, p. 31-50, 2010.). Conversely, the education expansion has a higher effect in the ESR composition which compensates for this fall in the age effect.

As observed by Rentería et al. (2016) in the case of Spain and Mexico, the educational attainment expansion has provided an alternative to overcome the economic effects of relative elderly population increase, because the ESR tends to continue positive even after the end of pure demographic dividend. This result is expected due to the increase of work productivity resulting from the growth in human capital (MANKIW et al., 1992).

The Brazilian case is important particularity in light of Brazil’s history of social inequality. The results show that the actual context - where we observe high inequality among the labor income and consumption age profiles by education groups and a high population share with low educational attainment – there is fertile field for robust economic growth, even after the end of the pure demographic dividend effect. When the expansion of post-secondary level is prioritized (high scenario) the life cycle deficit of this educational group in Brazil is significantly lower than of the other groups. Over the entire period analyzed (1970-2100), in both medium and high scenarios the Brazilian ESR tends to be positive because of this context, differing from that of Spain and Mexico, which, as demonstrated in Rentería et al. (2016), show a negative ESR in the medium scenario.

Our results indicate a need for further research in this area. First, it will be useful to incorporate the rate effects by building labor income and consumption age profiles for different periods going back to the 1970s. Secondly further investigation into gender differences in the labor income profile is necessary in order to simulate the gender dividend in interaction with age and education.

Notes

-

1

The same logic applies to g(C).

-

2

The same logic applies in the case of C(t).

References

- BLOOM, D. E., WILLIAMSON, J. G. Demographic transitions and economic miracles in emerging Asia. World Bank Economic Review, v. 12, n. 3, p. 419-455, 1998.

- BONGAARTS, J. The causes of educational differences in fertility in sub-Saharan Africa. Vienna Yearbook of Population Research, v. 8, p. 31-50, 2010.

- CRESPO-CUARESMA, J.; LUTZ, W.; SANDERSON, W. C. Is the demographic dividend an education dividend? Demography, v. 51, n. 1, p. 299-315, 2014.

- CARVALHO, J. A. M.; WONG, L. A. Window of opportunity: some demographic and socioeconomic implication of rapid fertility decline in Brazil. Belo Horizonte: Cedeplar/ UFMG, 1995. (Texto para discussão, 91).

- CUTLER, D.; POTERBA, J.; SHEINER, L.; SUMMERS, L.; AKERLOF, J. An aging society: opportunity or challenge. Brookings Papers on Economic Activity, v. 21, n. 1, p. 1-73, 1990.

- DAS GUPTA, P. Standardization and decomposition of rates: a user’s manual. US Bureau of Census, Current Population Reports, Series P23-186. Washington, DC: US Government Printing Office, 1993.

- IBGE – Instituto Brasileiro de Geografia e Estatística. Sistema de Contas Nacionais: Brasil. Rio de Janeiro, 2016. Available at: https://www.ibge.gov.br/estatisticas-novoportal/economicas/contas-nacionais/9052-sistema-de-contas-nacionais-brasil.html

» https://www.ibge.gov.br/estatisticas-novoportal/economicas/contas-nacionais/9052-sistema-de-contas-nacionais-brasil.html - IBGE – Instituto Brasileiro de Geografia e Estatística. Pesquisa de Orçamentos Familiares 2008-2009 – POF. Rio de Janeiro, 2010.

- MANKIW, N. G.; ROMER, D.; WEIL, D. W. A contribution to the empirics of economic growth. Quarterly Journal of Economics, v. 107, n. 2, p. 407-437, 1992.

- MASON, A. Demographic transition and demographic dividends in developed and developing countries. In: UNITED NATIONS EXPERT GROUP MEETING ON SOCIAL AND ECONOMIC IMPLICATIONS OF CHANGING POPULATION AGE STRUCTURE. Proceedings [...]. Mexico City: United Nations, Population Division, 2005.

- MASON, A.; LEE, R. Reform and support systems for the elderly in developing countries: Capturing the second demographic dividend. Genus, v. 52, n. 2, p. 11-35, 2006.

- MENEZES, F. N.; FERNANDES, R.; PICHETTI, P. Educação e queda recente da desigualdade no Brasil. In: BARROS, R. P.; FOGUEL, M. N.; ULYSSEA, G. (org.). Desigualdade de renda no Brasil: uma análise da queda recente. Brasília: Ipea, 2007. p. 285-304.

- OOSTHUIZEN, M. Bonus or mirage? South Africa’s demographic dividend. Journal of the Economics of Ageing, v. 5, p. 14-22, 2015.

- PRSKAWETZ, A.; SAMBT, J. Economic support ratios and the demographic dividend in Europe. Demographic Research, v. 30, n. 34, p. 963-1010, 2014.

- QUEIROZ, B. L.; TURRA, C. M. Window of opportunity: socioeconomic consequences of demographic changes in Brazil. Washington, DC: NTA, 2010.

- RENTERÍA, E.; SOUTO, G.; MEJÍA-GUEVARA, I.; PATXOT, C. The effect of education on the demographic dividend. Population and Development Review, v. 42, n. 4, p. 651-671, 2016.

- ROSERO-BIXBY, L. Generational transfers and population aging in Latin America. Population and Development Review, v. 37, suppl., p. 143-157, 2011.

- SOLOW, R. M. A contribution to the theory of economic growth. Quarterly Journal of Economics, v. 70, p. 65-94, 1956. DOI:10.2307/1884513.

- UNITED NATIONS. National transfer accounts manual. Measuring and analysing the generational economy. New York: Population Division, Department of Economic and Social Affairs, United Nations Publication, 2013.

- WICD – Wittgenstein Centre for Demography and Global Human Capital. Wittgenstein Centre Data Explorer Version 1.2. 2015. Available at: http://www.wittgensteincentre.org/dataexplorer

» http://www.wittgensteincentre.org/dataexplorer

Publication Dates

-

Publication in this collection

21 Aug 2020 -

Date of issue

2020

History

-

Received

20 Aug 2019 -

Accepted

14 July 2020

Source: IBGE. Pesquisa de Orçamento Familiar (POF). Own elaboration.

Source: IBGE. Pesquisa de Orçamento Familiar (POF). Own elaboration.

Source: IBGE. Pesquisa de Orçamento Familiar (POF). Own elaboration.

Source: IBGE. Pesquisa de Orçamento Familiar (POF). Own elaboration.

Source: IBGE. Pesquisa de Orçamento Familiar (POF). Own elaboration. Note: One individual in the sample, aged between five and nine years of age, and 13 individuals between the ages of 10 and 14, state they have completed secondary education, while the normal age for completing this stage of education in Brazil is 17-18 years of age. These cases were not excluded in order to not compromise the representativeness of the sample analyzed.

Source: IBGE. Pesquisa de Orçamento Familiar (POF). Own elaboration. Note: One individual in the sample, aged between five and nine years of age, and 13 individuals between the ages of 10 and 14, state they have completed secondary education, while the normal age for completing this stage of education in Brazil is 17-18 years of age. These cases were not excluded in order to not compromise the representativeness of the sample analyzed.

Source: IBGE. Pesquisa de Orçamento Familiar (POF). Own elaboration.

Source: IBGE. Pesquisa de Orçamento Familiar (POF). Own elaboration.

Source:

Source:  Source:

Source:  Source:

Source:  Source:

Source:  Source: Own elaboration based on decomposition exercise.

Source: Own elaboration based on decomposition exercise.

Source: Own elaboration based on decomposition exercise.

Source: Own elaboration based on decomposition exercise.

Source: Own elaboration based on decomposition exercise.

Source: Own elaboration based on decomposition exercise.