Abstract:

This paper proposes to test the possible existence of a long-term relationship between the exchange rate and world income variables on the performance of Brazilian soybean exports. For this purpose, an econometric model capable of describing the level of sensitivity (elasticity) of the explanatory variables between January 2000 and December 2015 is estimated. The empirical strategy adopted was the use of time series methods, unit root test, Johansen cointegration test, autoregressive vector model (VAR), called error correction vector model (VECM), impulse-response function and the decomposition of variance prediction errors. The results showed that only the global income variable was relevant to explain the oscillations that occurred over time in the dependent soybean export variable, revealing the importance of the international scenario for the Brazilian sales of the commodity. The variable exchange rate showed a sign contrary to economic theory; however, it registered a significant coefficient. In the short-term analysis, it was observed that there is a certain time lag for short-term imbalances to be corrected in the long run.

Key-words:

Soybean export; world income; VEC model

Thumbnail

Thumbnail

Thumbnail

Thumbnail

Thumbnail

Thumbnail

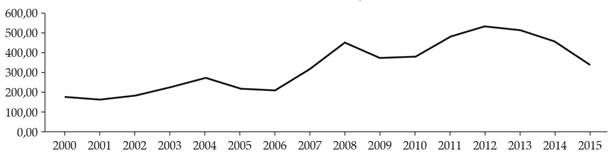

Fonte: Indexmundi, 2016. Elaboração própria.

Fonte: Indexmundi, 2016. Elaboração própria.

Fonte: Elaboração própria a partir dos dados da pesquisa, 2016.

Fonte: Elaboração própria a partir dos dados da pesquisa, 2016.

Notas: 1) LN = indica que as variáveis estão expressas em logaritmos. Fonte: Elaboração própria a partir dos dados da pesquisa, 2016.

Notas: 1) LN = indica que as variáveis estão expressas em logaritmos. Fonte: Elaboração própria a partir dos dados da pesquisa, 2016.