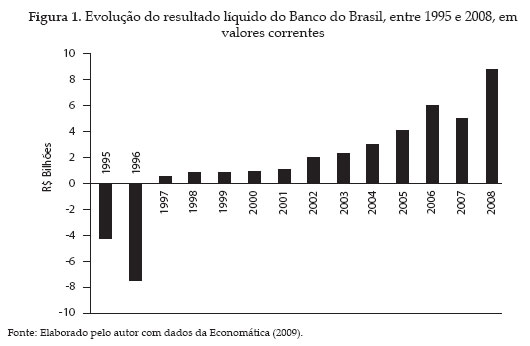

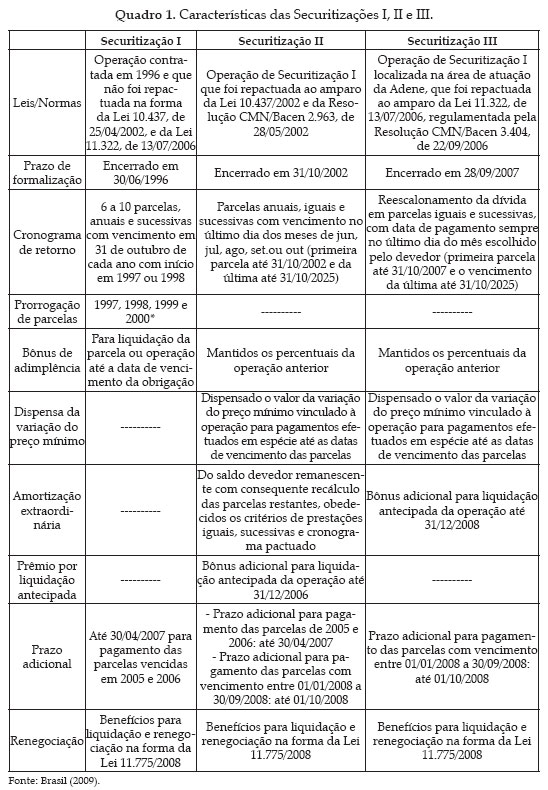

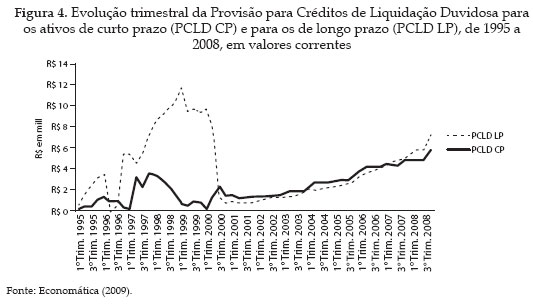

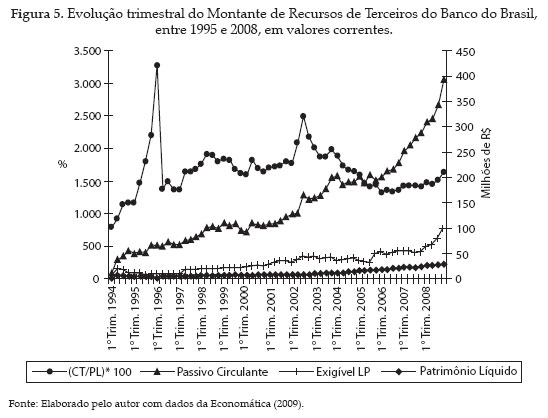

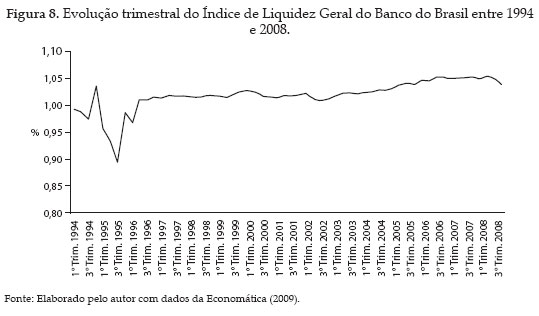

At the beginning of the 90's farmers were indebted. They were not able to pay their loans if there had not been a renegotiation called securitization. As it is the most important institution in terms of rural credit, Bank of Brazil had negative impacts in its results caused by the default of producers. After a long negotiation process, the 9138 Act was approved in 1995 as one of the first steps of securitization's debt process. From the interpretation of laws about securitization and from analysis of data in the report of the Banco do Brasil, a detailed analysis of economic and financial behavior of that institution was made and it was found that the securitization process was essential for the bank to reverse its losses into profits.

Banco do Brasil; Securitization; Rural debt