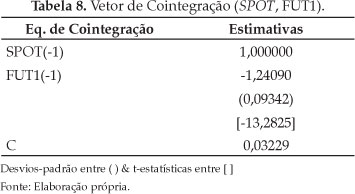

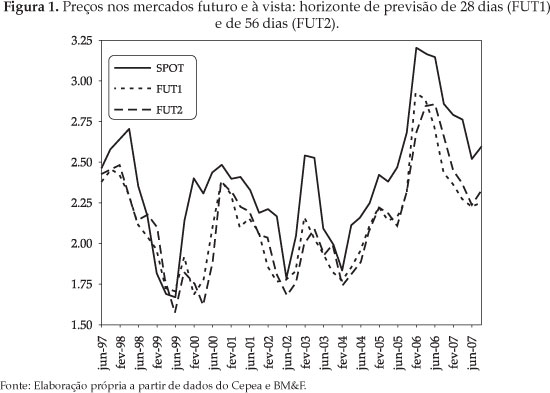

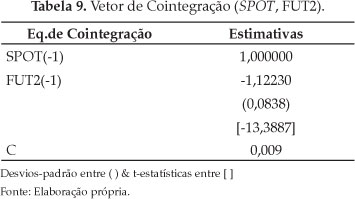

This study tests the relative efficiency hypothesis of future and spot sugar markets for two forecast horizons, as opposed to commodity arbitrage. It was used a no-arbitrage model of Brenner and Kroner (1995) and applied the methodology of comparative tests proposed by Kellard (2002), using multivariate cointegration methodology with restrictions on the cointegrated space. The database is formed by future prices of the number 11 contract traded on the Nybot (New York Board of Trade), domestic spot prices collected by Cepea (Center for Advanced Studies in Applied Economics) and the domestic interest rate, all on daily basis (May/97 to Dec/07). The matching sample is constructed by the futures contract maturity, considering two periods of forecast: 28 and 56 days. In general, the empirical evidences support the appropriateness of the cointegration methodology for analyzing the relative efficiency in the sugar markets, as opposed to arbitrage hypothesis, and generate weak evidence of inefficiency. Such results are subject to the assumption of stationarity of the cost of carry, except the interest rate component.

sugar futures market; efficiency; arbitrage; cointegration