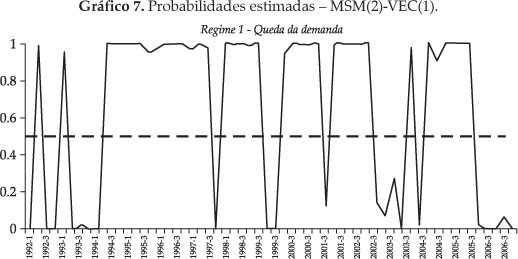

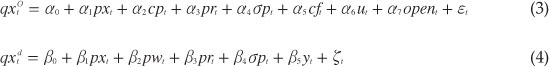

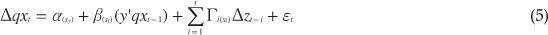

The goal of this paper is to apply the linear and nonlinear error correction model to supply and demand for rubber exports and find elasticities to several variables. Two major contributions emerge from this research. The first is the use of the methodology of Markovian Switching model. The second is related to the results for the sector. For the supply curve is not possible to affirm the existence of the J effect. There is evidence of asymmetry in performance between states of retraction and growth in demand for exports, as well as between the duration of these states. This may reflect the influence of short-term elasticities, particularly in the case of income and prices. Overall, the results show that negative shocks have much more power to destabilize the exports sector in Brazil than positive shocks.

Markov Switching Models; exports; supply and demand functions